Home/mortgage Loan

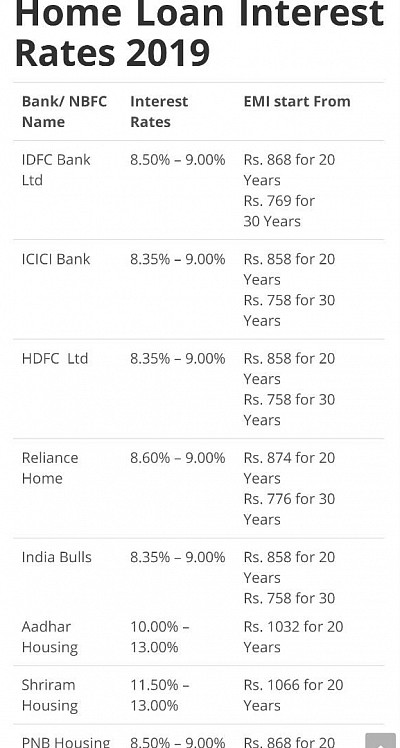

Bhagyalaxmi finserv provides the lowest rate of the market. You can compare all the loan providers offer under a single roof. A home loan can be used to buy a new property like flats, bungalow, and row houses also. Banks generally provide 80% to 90% of the property value as a home loan. The remain balance has to be arranged as the initial down payment. You can also avail a personal loan for further down payment amount. Nowadays some builders provide fully furnished flats to enable higher loan amount. This also reduces the cost of furnishing the house on possession. Home loans are available from 5 lac to 25 Cr. Dealsofloan.com suggests you the lowest rate of interest.

After applying for a Home Loan there are lots of parts included in availing Home Loan starting with identifying your property to filling up the loan application form. Following are the important stages in Home Loan approvals:

Documents Required

Colour Photo

PAN Card Copy

Last 6 months bank A/C statement

Passport size photograph of the applicant & co-applicant

Age proof of co-applicant

Residence Address Proof

Tax Benefits in Home LoanThe home loan borrower enjoys Tax Benefits on both Interest paid & the Principal re-paid. Under Section 24(d) of Income Tax, the deduction of interest payable on the home loan is up to a maximum of Rs. 1,50,000.

Under Section 80(c) of Income Tax, Principal amount for the repayment of loan along with other savings & investments is eligible for tax deduction up to a maximum limit of Rs. 1, 00,000.